Will Your Search History Affect Your Credit Score?

How data mining companies are using your non-private search engine data to make predictions about how likely you’re to make a payment on-time

Protecting your search and your browsing history has never been more important. We live in the era of “Surveillance Capitalism”—dubbed by scholar Shoshana Zuboff—where increasingly cunning methods of gathering information about you are being devised.

Your online searches, browsing history, and digital purchases, which provide heaps of information about you, are being bought and sold by advertising and data harvesting companies. Non-private search engines profit off your information and allow companies to predict your behavior so that you will buy more stuff, feel a certain way — in a word, control you.

The situation is more heightened in the financial industry, where an “intensifying data arms race” is taking place, according to Madga Ramada Sarasola. (https://www.economist.com/finance-and-economics/2017/02/09/big-data-financial-services-and-privacy)

How Financial Institutions Use Your Non-Private Search Engine Data

We’ve entered the “all data is credit data era,” in which lenders and financial institutions leverage as much information as they can about you. They say it is to open doors for “unbanked” people and those with a limited credit history. Covertly, it’s a data arms race to see who can rack up the most information on you and take the most advantage.

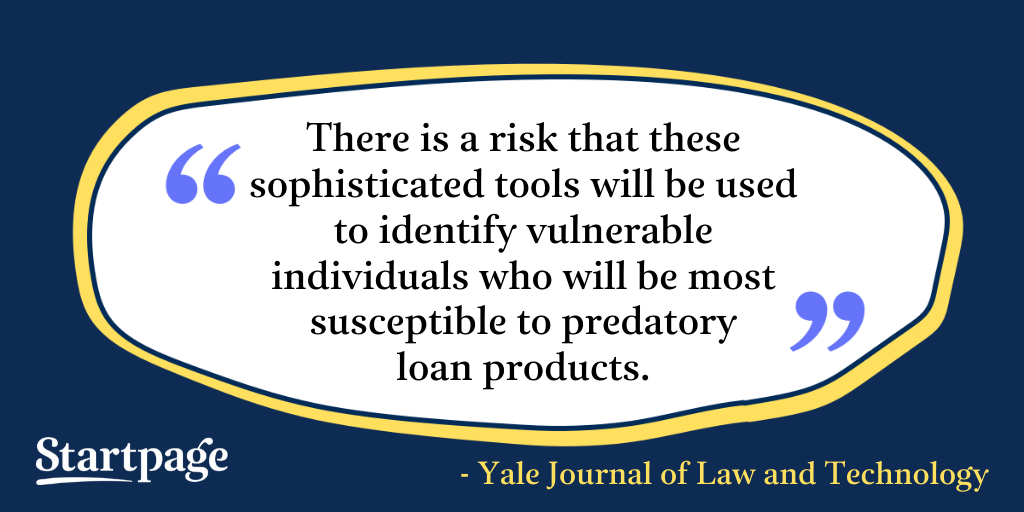

According to the Yale Journal of Law and Technology, “Given that big-data scoring tools are becomingly increasingly prevalent in the online payday-lending industry, there is a risk that these sophisticated tools will be used to identify vulnerable individuals who will be most susceptible to predatory loan products.” (https://digitalcommons.law.yale.edu/cgi/viewcontent.cgi?article=1122&context=yjolt)

Search engines are a major vector for such targeted, predatory practices. On non-private search engines, the results and advertisements you see are based on a profile of you, with results tweaked to cater to what an algorithm thinks you are more likely to engage with. That means if someone thinks you’re vulnerable or desperate, you are far more likely to see yourself targeted in search results and advertisements engineered to take advantage of that.

Researchers analyzed data from 270,399 purchases from an e-commerce company and claim to have beaten traditional credit score prediction when it came to whether a customer would make a payment on time or not. They stated that the search engine personal data that they used in their research was one of the strongest signals to indicate if someone was significantly more likely to default. (https://www.nber.org/papers/w24551)

As data mining companies continue to collect and study people’s persona data, and the “all data is credit data” attitude becomes more pervasive, there is a risk of unfair and discriminatory practices based on the perceived predictive power of the data you generate online. (https://www.wired.com/story/your-smartphone-could-decide-whether-youll-get-a-loan/?GuidesLearnMore) A more robust and totalizing—and chilling—form of this already exists in China with their “social credit score.” (https://time.com/collection/davos-2019/5502592/china-social-credit-score)

The Government Will Take Care of It, Right?

Although policies like General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) regulates what data can be collected and used but, it’s not an end-all solution. (https://startpage.gg/blog/privacy-news/overview-startpage-gdpr-ccpa) The real problems persist: 1) data mining companies can still access your data and 2) draw conclusions based on that data.

The collection of data itself is one thing, but the legal and ethical status of the analysis performed using that data, and the conclusions drawn, are slipperier still. So while current regulation has indeed begun addressing issues of data privacy, the actual reality is very fast-moving and secretive, with no sign of a satisfactory resolution any time soon.

Yikes. What can we do to protect ourselves from intrusive data collection in the meanwhile?

The good news is that you don’t have to wait for companies to grow a conscience or for regulators to create effective legislation governing the collection and use of your data. There are still things you can do in the meanwhile:

- Use Startpage’s “Anonymous View” to protect yourself while you browse. Anonymous View allows you to browse search results without the websites you visit ever knowing you were there. Read more about Anonymous View here: https://startpage.gg/en/anonymous-view/

- Using a budgeting or financial app? Familiarize yourself with your banks’ controls for third-party connections. That way, if you do rely on budgeting or other financial apps that require access to your bank details, you can be better protected. A helpful list is available here: https://www.consumerreports.org/privacy/consumers-get-more-control-over-banking-data-shared-with-financial-apps/

- Always check the settings in whatever service or app you’re using to make sure you are dialing up their privacy options to the max. Companies love to take advantage of the fact that many people never bother to check these.